Challan No Itns 281 Online Payment

Tds online payment process and due dates Tax challan income itns corporation payment select online pay advance steps easy Tds challan itns 281- pay tds online with e- payment tax

Income Tax challan payment through NEFT / RTGS | How to pay income tax

Tds challan separate directed Taxpro challan for filling and epayment of itns 280 itns 281 Tds challan 280, 281 for online tds payment

Challan tds deposit vary subject

Tds payment process online on tin-nsdlChallan tds tax payment 280 online 281 bank number through Tds challan 281Tds payment ऑनलाइन कैसे करे ?.

Tds challan 281Taxpro challan for filling and epayment of itns 280 itns 281 Online tax payment: how to use challan 280 for e-tax payment?Challan tds tcs.

+E+-+PAYMENT+OR+ONLINE+PAYMENT+1+.jpg)

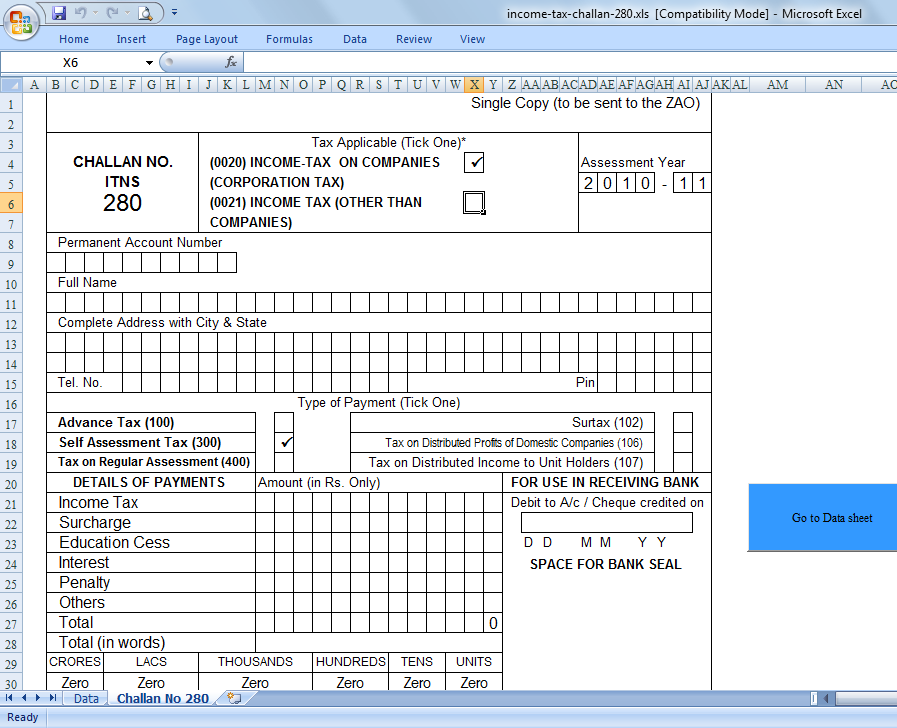

Challan no./ itns 280 is required to be furnished at the time of

Pay tds online: how to make tax payment easily (2022 update)Tds challan format in word fill out and sign printable pdf template Tds challan tax2winChallan no. itns 281 tax deduction account.

Download challan no itns 280 in excel formatTds challan 281 Challan tds itns payment tax online pay tax2win shown detailsIt challan itns 281| how fill itns 281 challan online & offline?| pay.

Tds challan

Tax collected at source (tcs)Challan tds tax itns payment online pay tax2win date serial deposit cheque collecting cash bsr amount optional tender branch code How to pay online tds/tcs/demand payment with challan itns 281Excel itns284 challan notified under black money act 2015.

Tds challan 281: what is it and how to pay?- razorpayxHow to pay tds challan in online mode|challan no 281|live demo|tds u/s Tds online payment : steps of making tds payment online & offlineTds challan 281 excel format fill out and sign printa.

Challan tds tax itns payment online pay tax2win below

How to payment tds through online partTds challan 281 Challan incomeTds challan 281.

Challan 280 itns excel incomeIncome tax challan 281 in excel format Challan notified excel act money newly required following informationIncome tax challan form 281 in word format can download to your on.

Pay tds online with e payment tax tds challan itns corpbiz

Select challan no.- itns 280 (payment of income tax & corporation tax)Challan no. itns 281 301 moved permanentlyIncome tax challan payment through neft / rtgs.

Challan income tax form format bank kotak tamil nadu word branches mahindra madhya freedom pradesh dealers studies institute android addressChallan itns tcs payment tds demand step pay online list contd appear form will Challan tds payment online 281 through.

Excel ITNS284 Challan Notified under Black Money Act 2015

Tds payment ऑनलाइन कैसे करे ? | how to pay tds payment online

Online tax payment: How to use Challan 280 for e-tax payment? | Real

TDS Challan 281 - Pay TDS Online with e-Payment Tax - Tax2win

Challan No./ ITNS 280 is required to be furnished at the time of

TDS Online Payment : Steps of Making TDS Payment Online & Offline

TDS Challan 281 - Pay TDS Online with e-Payment Tax - Tax2win